missouri employer payroll tax calculator

If you work for yourself you need to pay the self-employment tax which is equal to both the. Below are your Missouri salary paycheck results.

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

Employees with multiple employers may refer.

. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. The maximum an employee will pay in 2022 is 911400. Missouri is currently not a credit reduction state.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Employers covered by the states approved UI program are required to pay 60 on wages up to 7000 per worker per year to the Federal UI. Paycheck Withholding Calculator Statement of Account.

Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes. Brush up your resume sign up for training and create an online profile with. Missouri Salary Paycheck Calculator.

The standard FUTA tax rate is 6 so your. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Its a progressive income tax meaning the more. To calculate Missouri taxable income taxpayers take their federal adjusted gross income AGI and then subtract or add certain types of income. Employers can use the calculator rather than manually.

Figure out your filing status. If you have misplaced this identification number and are an authorized person for the account you may call 573 751-5860 to obtain. Paycheck calculators Payroll tax rates Withholding forms Small business guides.

For example contributions made to a. Employers can use the calculator rather than manually. Just enter the wages tax withholdings and other information required.

Missouri Tax Registration Application Form 2643. Missouri Hourly Paycheck Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Additions to Tax and Interest. Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri.

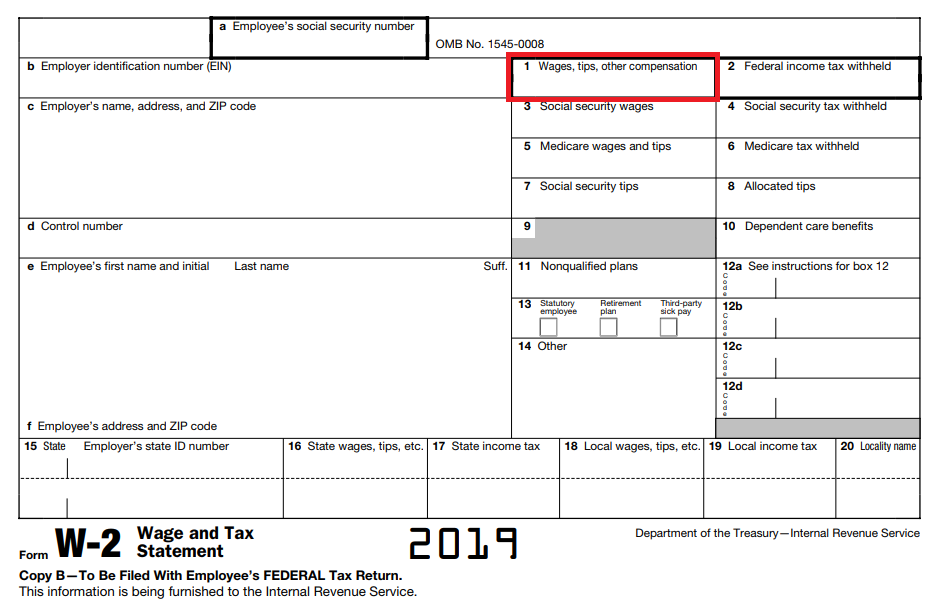

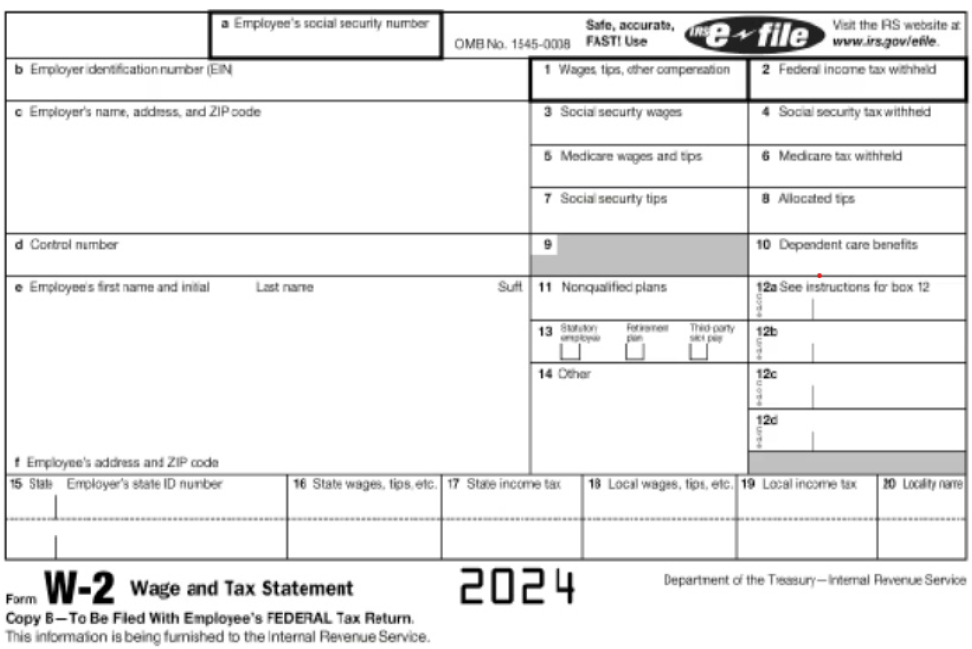

Paycheck Results is your gross pay and. So the tax year 2022 will start from July 01 2021 to June 30 2022. The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

The first step is to calculate the payroll tax in Missouri with the Missouri payroll tax calculator and apply the state tax rate to the earnings of all firms starting at 15. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. The results are broken up into three sections.

Employer tax in Georgia employee tax. Missouri Hourly Paycheck Calculator Results.

Missouri Dor Tax Resolutions Consequences Of Back Taxes

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Employer Payroll Tax Obligations When Employees Work Out Of State Anders Cpa

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

![]()

Missouri Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Missouri Income Tax Rate And Brackets H R Block

Ways To Calculate Wage Garnishment In Missouri

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Check On My Missouri State Tax Refund

Llc Tax Calculator Definitive Small Business Tax Estimator

Working From Home During The Pandemic Doesn T Include Tax Breaks Stlpr

Missouri Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Last Week In Payroll Repaying Deferred Social Security Taxes

Free Employer Payroll Calculator And 2022 Tax Rates Onpay